Introduction

As we step into the future, Digital Transformation (DX) is reshaping industries far and wide - accounting being no exception.

Evolving from traditional paper-based systems to advanced digital solutions, accounting is undergoing momentous changes.

The integration of artificial intelligence, cloud computing, and advanced analytics into accounting processes is revolutionizing the way accounting operations are carried out.

This blog post throws light on the significance of embracing digital transformation in accounting, providing a roadmap to successful implementation and real-life success stories of businesses that have greatly benefited from DX in accounting.

The Definition of Digital Transformation in Accounting

With the rapid evolution of technology, the conversation about digital transformation (DX) has extended its footprint in vast professional fields, including the financial landscape.

Here, DX for accounting refers to the systematic adoption of digital technologies that automate, streamline, and enhance traditional accounting processes, thereby making them more efficient, accurate, and opportune.

It involves a fundamental shift from manual to automated operations, harnessing the power of technologies like artificial intelligence (AI), machine learning, and cloud computing.

The Importance of Digital Transformation in Accounting

Why exactly is DX so vital in accounting? To broadly categorize, there are three key reasons - Competitive Edge, Performance Optimization, and Risk Mitigation.

Competitive Edge

Today, organizations are on a quest for speed and responsiveness to meet client expectations and seize business opportunities.

Delayed insights usually mean wasted opportunities. With DX, accounting departments shift from being reactive to proactive.

Real-time access to crucial financial data allows businesses to stay ahead of the curve, offering them a competitive advantage.

Instant budget updates, predictive models, and real-time analysis foster agility, allowing stakeholders to deliver strategic, timely decisions that accelerate growth.

Performance Optimization

The implementation of cutting-edge technology brings an unmatched efficiency to accounting processes.

With operational activities streamlined and automated, accountants can redirect their efforts and time towards more strategic roles, including advisory and decision-making.

DX has the potential to reinvent an accountant’s role from a financial guardian to a business strategist.

Moreover, automation minimizes errors, improving the accuracy, reliability, and trust in financial data and reports.

Risk Mitigation

DX in accounting helps businesses fortify their defenses against cyber threats with advanced measures such as encryption, cloud security, secure access, and automatic software updates.

Simultaneously, digital tools enable accountants to meet the regulatory compliance seamlessly.

They can keep track of new updates, automate the compliance processes, and offer detailed audit trails when required.

This dual function of risk mitigation, both on cyber security and compliance fronts, can prevent substantial financial and reputational loss.

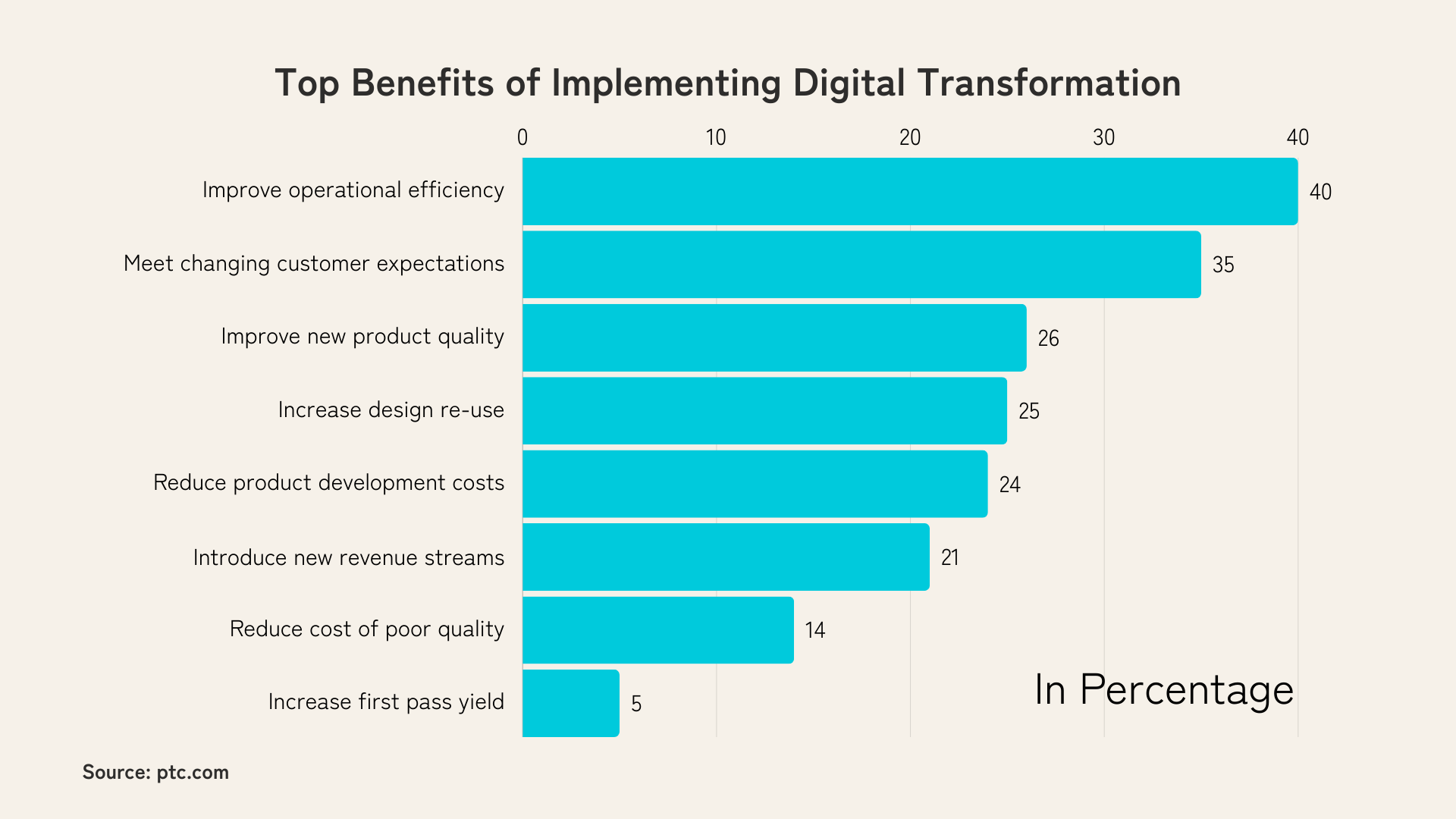

8 Benefits of Digital Transformation in Accounting

Integrating digital transformation (DX) strategies is imperative for accounting departments to remain competitive.

This integration streamlines processes, increases efficiency, and enhances customer satisfaction.

But what are the specific benefits of implementing DX in accounting?

Here are eight key benefits of digital transformation in accounting:

#1 Increased Efficiency

By automating mundane tasks, DX frees up accountants' time, enabling them to focus on higher value-added tasks, such as strategic planning and advisory roles.

Automating tasks can both minimize errors and reduce operational hours, ultimately leading to increased productivity and more efficient working practices.

#2 Improved Accuracy

The potential for human-induced errors diminishes with automation. Digital tools perform calculations, generate reports, and detect anomalies, ensuring high precision in financial data.

This accuracy boosts stakeholder confidence and allows business decisions to be made using reliable information.

#3 Cost Savings

DX reduces operational costs by streamlining processes and minimizing errors.

This results in reduced time invested in tasks, fewer resources spent on office supplies such as paper and printing, and lower expenses related to rectifying errors.

These direct cost savings contribute positively to a company's bottom line.

#4 Enhanced Collaboration and Communication

DX facilitates seamless communication and collaboration between team members through digitized workflows and shared databases.

This ensures that tasks are assigned effectively and processes are executed smoothly, adding value to operational efficiency.

Moreover, real-time data access keeps everyone on the same page, leading to faster decision-making and better alignment.

It is stated on Sage Research, 58% percent of accountants agree that cloud technology makes their role easier by enabling collaboration with clients and improving service offerings.

#5 Advanced Analytics and Data-driven Insights

Digital transformation enables the use of advanced analytics tools, which empower accountants to leverage raw financial data and transform them into actionable insights.

These insights reveal trends and patterns, which can be used to make informed decisions regarding cash flow management, revenue projections, and investment strategies.

#6 Enhanced Security and Compliance

Integrating DX into accounting processes improves data security and helps organizations maintain regulatory compliance.

This can involve encryption, two-factor authentication, and automatic software updates.

Additionally, digital tools can simplify the process of regulatory compliance, ensuring businesses remain aligned with evolving financial reporting standards.

#7 Increased Scalability

DX introduces scalable technology solutions that grow with the organization. Cloud-based accounting systems, for instance, offer the flexibility to upgrade or downsize resources as per the business needs.

This adaptability allows businesses to respond quickly to changing market conditions and enjoy a competitive advantage.

#8 Better Customer Experience

Finally, DX improves customer satisfaction by delivering personalized, efficient experiences.

Real-time financial reporting, quicker response times to queries, and self-service portals provide clients with unparalleled convenience.

Moreover, with access to accurate data analytics, businesses can identify trends and tailor their services accordingly.

The Role of Digital Transformation in Accounting

Streamlining Operations

DX automates repetitive tasks, such as data entry, invoice processing, and payroll management.

This automation reduces human intervention, resulting in faster completion of tasks and fewer errors.

For instance, AI-powered invoice processing tools can automatically extract data from invoices, categorize them, and update the accounting records.

Automating these processes drastically cuts down the time spent on manual data entry and boosts efficiency in accounting operations.

Real-time Reporting and Analysis

With DX, accountants gain access to real-time data, enabling prompt financial reporting and analysis.

According to Gartner, 90% of corporate strategies will explicitly include information as a crucial business asset and analytics as a critical capability.

Integration of modern technologies, like cloud accounting systems, ensures that financial data is updated continuously.

For example, connecting bank accounts to accounting software allows automatic syncing of all financial transactions.

This enables accountants to track cash flows, monitor budgets, and draft financial statements instantly, leading to quicker, more informed decision-making.

Data-driven Decision Making

The integration of advanced analytics tools into the accounting process facilitates data-driven decision-making.

Accountants can now use predictive analytics and machine learning algorithms to identify patterns and trends in financial data that were previously difficult to detect.

Businesses can leverage these insights to make intelligent decisions for improving financial performance and fostering growth.

For instance, data analytics can reveal a regular dip in sales during specific months, which can prompt management to create targeted marketing campaigns or develop seasonal offers to boost revenues.

Enhancing Security and Compliance

Incorporating DX in accounting strengthens data security and simplifies compliance management.

Cloud-based accounting solutions provide multiple layers of protection, including encryption and secure access control.

For example, two-factor authentication prevents unauthorized users from accessing sensitive financial data.

Additionally, DX simplifies regulatory compliance by keeping track of evolving regulations and automating report generation accordingly.

Digital tools can help businesses stay up-to-date with tax-related changes, generate necessary filings, and ensure timely submissions to relevant authorities.

How to Implement Digital Transformation in Accounting: Step by Step Guide

#1 Assessing Current Accounting Practices

The first step involves auditing the existing accounting practices in your organization. Identify what processes are currently automated, which systems are used, and where manual interventions still exist.

For instance, if your business currently manages financial data in Excel spreadsheets and manually generates invoices, these are ripe opportunities for automation and digitization.

#2 Identifying Digital Needs and Goals

Following the assessment, you'll need to outline your digital needs and goals. Prioritize areas where automation can bring immediate impact, such as mundane tasks or time-consuming operations like data entry or reconciliation.

Your goal could be to streamline these areas for improved efficiency and reduced processing time.

#3 Selecting Suitable Technology and Software

The market is replete with numerous software options catering to varied accounting needs. The key is to choose technology that aligns with your needs and business size.

If most of your employees work remotely, a cloud-based accounting solution could fit your needs.

If invoice processing is extensive and time-consuming, look for a solution that offers automated invoice processing.

#4 Training Accounting Personnel

Introducing new technology inevitably necessitates training for accounting personnel. Ensure that your team is well-versed with the digital tools before integration.

This could involve webinars, hands-on workshops, or even employing an expert. Remember, your digital transformation is only as effective as the people using the technology.

#5 Implementing and Monitoring the Changes

After training, proceed with the implementation. Start small; possibly with a pilot project to gauge the effectiveness and refine if needed.

It’s also essential to establish metrics to measure performance and improvements.

For example, measure the time taken to process invoices pre and post-implementation. Iterate and improve based on these findings.

Case Studies: Successful Implementations of Digital Transformation in Accounting

Grant Thornton, a global name in audit, tax, and advisory services, stands as an epitome of Digital Transformation in Accounting, testament to the power of technological innovation and strategic execution.

Recognizing the intricate world of tax compliance and the firm's commitment to delivering high-quality services, Grant Thornton focused its DX initiatives on streamlining and automating tax-related processes.

The firm mapped out its approach, placing a clear emphasis on automation, accuracy, and value-added services.

They implemented ONESOURCE, a comprehensive tool that aids in tax calculation, compliance reporting, and data management.

By transferring data maintenance to an automated platform, Grant Thornton alleviated its staff from the burden of manual data entry and maintenance.

The software's ability to adapt to different country's tax rules and translate them into the local language is a massive bonus for a global firm like Grant Thornton.

As a result, the firm could maintain high levels of regulatory compliance while simplifying international transactions, ultimately enhancing client satisfaction.

Another key aspect of Grant Thornton’s digital journey was the deployment of Voyager suite, an audit tool that adds value throughout the audit cycle.

Incorporating predictive analytics, risk assessments, and automation, Voyager suite enabled the firm to deliver high-quality audits and provide deeper business insights, enhancing client satisfaction.

In conclusion, Grant Thornton's digital transformation is a beacon for accounting firms worldwide.

Their successful strategy combining technology and service improvement offers a blueprint for others embarking on their own digital transformation journey.

They've demonstrated that incorporating well-chosen digital tools can enhance productivity, drive efficiency, and ultimately lead to improved client services in the accounting sector.

Are you ready to revolutionize your accounting processes?

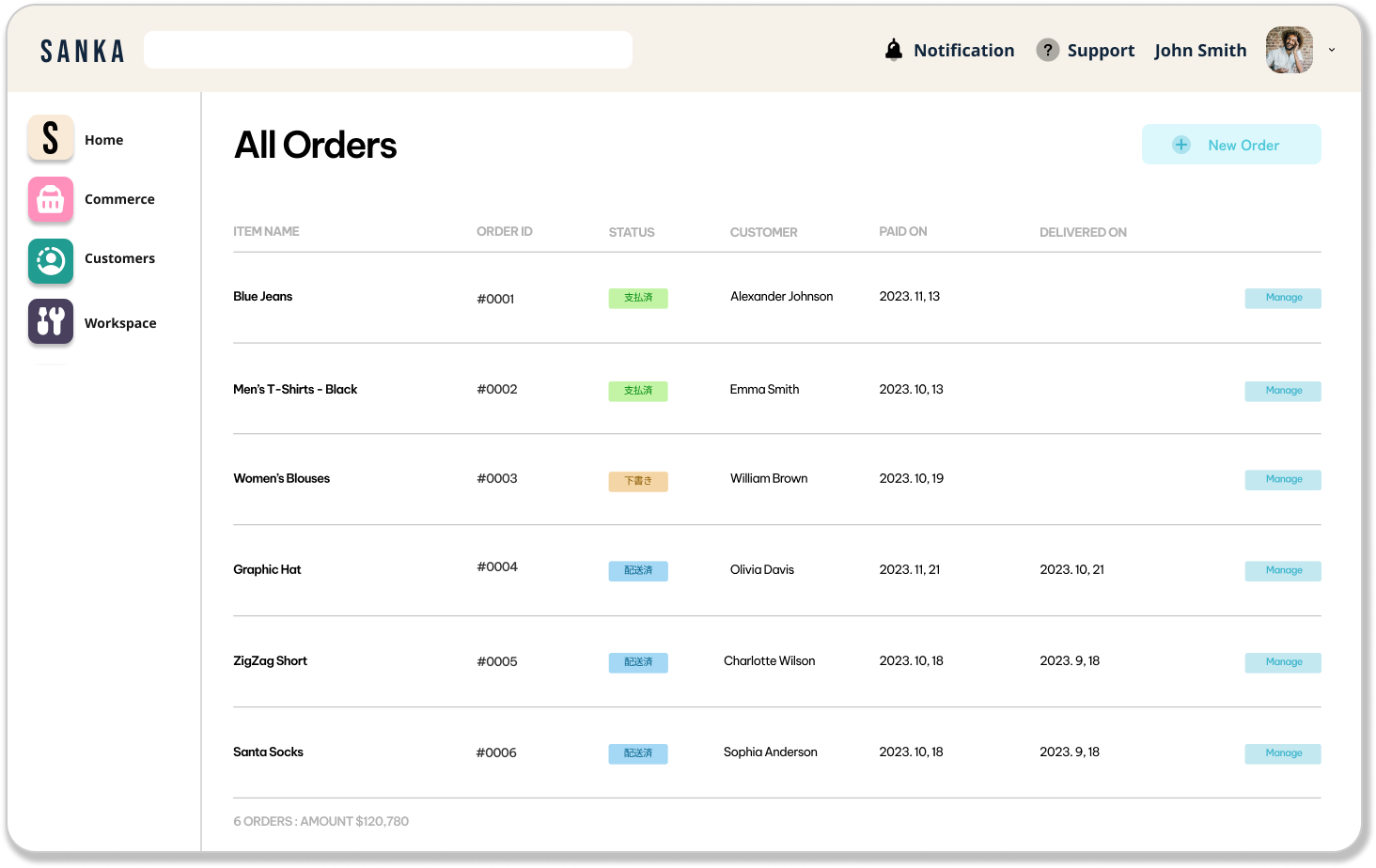

Experience the power of digital transformation with Sanka's all-in-one platform for seamless accounting and business operations.

Join the community of progressive businesses that benefit from cost savings, operational efficiency, and streamlined workflows.

Sanka combines 20+ essential accounting and business apps in a single subscription, making it more affordable and efficient for your organization.

Don't miss out on this opportunity to elevate your accounting game! Discover the future of accounting with Sanka today!

Start your free trial now and experience the breakthroughs Sanka can bring to your business!

Conclusion

In the grand scope of industry evolution, those who adapt, survive, and thrive. The domain of accounting too, can’t escape from the winds of change brought about by digital transformation.

Businesses that embrace DX will herald increased efficiencies, cost-saving, improved accuracy, and better decision-making capabilities.

The road to digital transformation may not be without challenges, but the benefits it entails make the journey worth undertaking.

Embracing the future means embracing digital transformation in accounting. It's not just a matter of staying relevant; it offers the chance to lead and define the future of accounting.