Introduction

The digitization wave is transforming industries across the globe, and the banking sector is no exception.

Traditional banking, characterized by long queues and exhaustive paperwork, is giving way to real-time, digital, and streamlined financial processes.

This blog post offers an in-depth look at the course of digital transformation in the banking industry, how some banks are leveraging digital technologies, and the challenges and trends associated with this evolution.

This change is not only reformulating customary banking norms but also fostering a new era of digital banks, AI-powered services, seamless transactions, and secured data management.

Digital Transformation in Banking: An Overview

Digital transformation in banking involves a shift from traditional physical banking to digital and online operations.

This transformation manifests through various trends such as mobile banking, AI-powered customer service, blockchain-backed secure transactions, and open banking services.

It has paved the way for 24/7 remote banking, real-time transactions, personalized financial services, and robust security mechanisms.

From digital-exclusive banks to AI-powered financial advisors, the digital transformation of banking is centered on offering seamless, round-the-clock banking services that meet the digital-savvy customer's expectations.

Driving Forces Behind the Digital Shift

Several factors contribute to the urgency of digital transformation in the banking industry, including:

- Changing Consumer Expectations: Modern customers expect convenient, fast, and personalized experiences, driving banks to implement digital technologies.

- Emerging Fintech Companies: The rise of fintech companies forces traditional banks to innovate and digitize their operations to compete effectively.

- Regulatory Changes: Data privacy laws and open banking policies push banks to update their procedures and systems.

The Importance of Digital Transformation in Banking and Financial Services

#1 Meeting Customer Expectations in the Digital Age

Consumers today expect a seamless, secure and personalized banking experience, much of which is driven by advancements in technology.

Banks that effectively use technology to enhance customer experience ultimately build long-term trust.

Digital banking solutions, such as mobile applications and online platforms, offer customers the convenience to manage all transactions and interactions with their bank from the comfort of their home or office.

Additionally, these digital platforms provide customized products and services depending on individual needs.

For instance, customers can apply for a loan, check their credit score, and receive personalized financial advice all within the same app.

#2 Streamlining Operations

Digital transformation dramatically augments the efficiency and productivity of banking operations.

Automated processes, from data entry and reconciliation to customer service interactions, reduce manual interventions, minimize human errors, and optimize costs.

Take Robotic Process Automation (RPA) for instance - it is used extensively for automating repetitive tasks, reducing the processing time and increasing efficiency.

Banks also use data analytics to process large volumes of data, delivering valuable insights for decision-making and strategic planning, and helping institutions stay ahead of industry trends.

#3 Enhancing Risk Management

The advent of sophisticated data analytics, predictive modeling, and machine learning have made it possible to identify and manage risks with remarkable precision.

These digital tools are essential for credit risk assessment, fraud detection, compliance, and ensuring data security.

Banks can leverage AI and machine learning to identify unusual patterns in transactions, proactively detecting potential fraud.

Similarly, predictive analytics can identify potential loan defaults, allowing banks to make informed decisions on loan disbursements and significantly reducing the risk of non-performing assets.

#4 Enabling Innovation with Fintech

Digital transformation in banking goes beyond just digitizing existing services.

It introduces new innovative business models by collaborating with Fintech companies.

Fintechs offer advanced solutions such as peer-to-peer lending, blockchain-based contracts, e-wallets, robo-advisors for wealth management, and more.

Traditional banks are now partnering with fintech companies to incorporate these technologies into their business framework.

This amalgamation of technology with finance is creating innovative, agile, and highly responsive banking services, bringing about a paradigm shift in how financial services are delivered.

#5 Improving Financial Inclusion

Digital banking and financial services are an effective tool to enhance financial inclusion worldwide.

The rise of neobanks or digital-only banks in regions with low banking penetration is a testament to this fact.

Mobile banking and e-wallets have made it possible for even the unbanked population to access critical banking services.

This affordability and ease of access are resulting in more individuals being included in the financial system, promoting economic growth in the process.

Examples of Digital Transformation in Banking

The rolling tide of digital transformations is redefining the banking industry.

Financial institutions worldwide are recognizing the necessity to innovate, adapt, and evolve their legacy models to meet modern demands.

These are some standout examples that aptly demonstrate how digital technologies are revolutionizing banking.

Mobile Banking

Arguably the most significant innovation, mobile banking has changed how customers interact with their banks.

Banks such as Barclays, Bank of America, and JP Morgan have developed user-friendly mobile apps offering customers full control over their financial operations from anywhere, anytime.

Transactions, balance checks, bill payments, and even loan applications are now executed with just a few clicks.

As an example, JPMorgan Chase invested over $10 billion in technology annually, developing a mobile banking app, and AI tool known as COIN, which processes legal documents analyzing them in seconds compared to the hours a human would take.

Innovative Payment Solutions

As cashless transactions become widespread, banks have rolled out innovative payment options.

Zelle, a digital payments network backed by several US banks like JPMorgan Chase and Bank of America, provides fast peer-to-peer money transfers.

Similarly, Sweden's SEB bank has partnered with the Danish payment service provider, Nets, to launch contactless payments through wearable devices.

This extensive range of payment methods ensures quick, convenient, and seamless transactions.

AI-Powered Customer Service

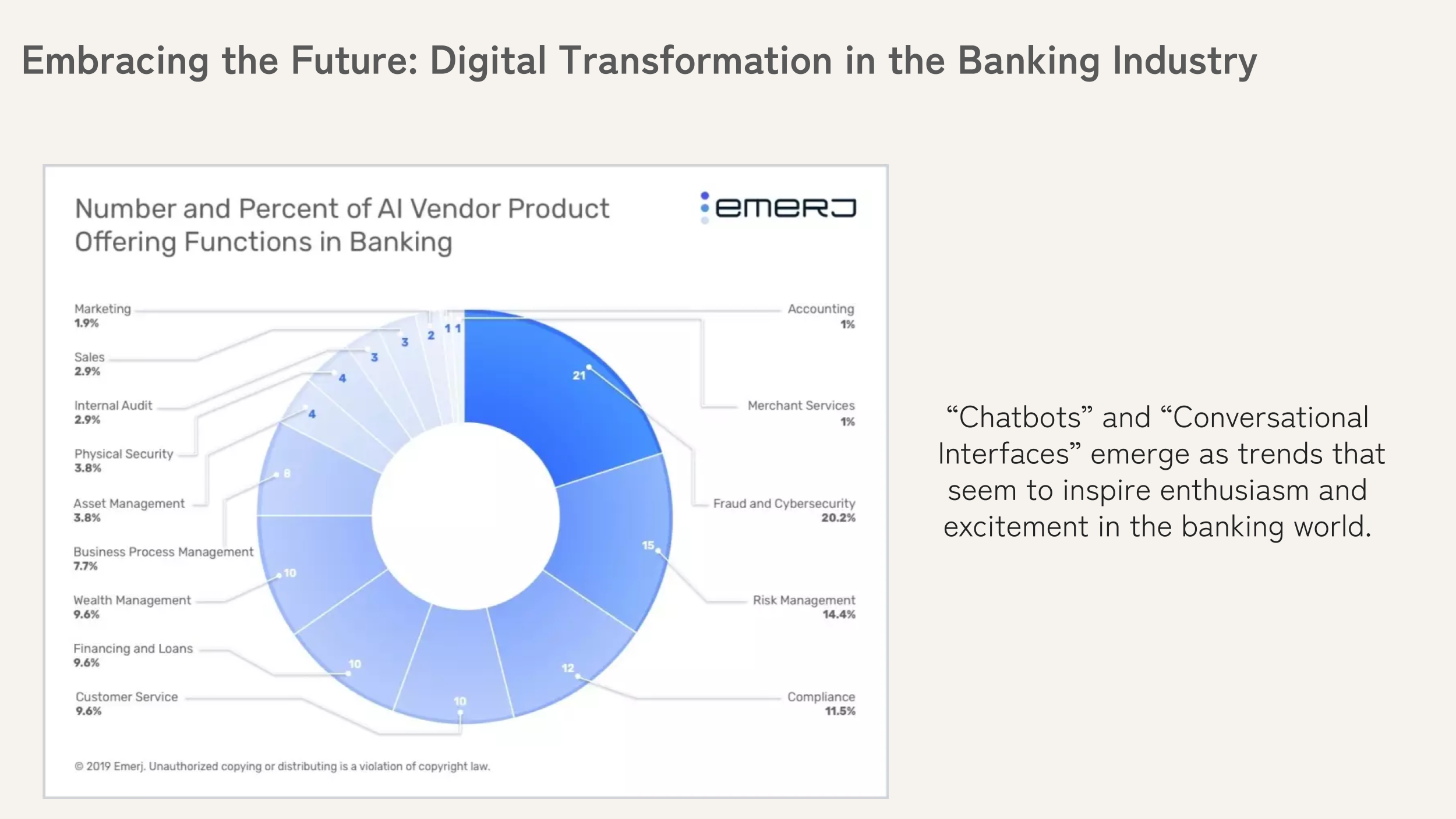

Banks like JP Morgan and Wells Fargo use Artificial Intelligence (AI) and Machine Learning (ML) to improve customer service.

Financial services statistics show that AI is reshaping customer interactions, with 37% of consumers having received financial assistance from AI-powered chatbots and shows that 69% of consumers are comfortable seeking advice from virtual assistants.

These technologies power virtual assistants and chatbots that can answer customer queries, provide information, and assist in executing transactions 24/7.

AI can also analyze customers' behaviors and spending patterns to provide personalized financial advice.

It allows banks to deliver personalized experiences, propelling customer satisfaction and loyalty.

Robotic Process Automation in Banking Operations

Robotic Process Automation (RPA) significantly streamlines banking operations and improves efficiencies.

For instance, Deutsche Bank implemented RPA to automate its anti-money laundering processes, reducing operational costs and expediting customer onboarding.

It is reported that the bank saved 210,000 hours of work that employees would typically do by hand.

Blockchain for Secure and Transparent Transactions

Various banks, including Santander and HSBC, are harnessing the power of blockchain technology for faster, more transparent, and secure transactions.

It allows banks to maintain a tamper-proof, decentralized ledger that facilitates seamless cross-border payments with real-time verification.

HSBC rolled their 'Digital Transformation for Banking' initiative that focalizes on four primary areas: customers, growth, optimization, and controls.

They launched mobile banking apps, voice recognition technology, and a robo-advisor—all boosting efficiency in service delivery.

Biometric Authentication for Enhanced Security

Biometrics authentication, such as fingerprint, facial recognition, or voice recognition, is revolutionizing the way banks safeguard customer information and ensure transaction security.

For instance, Citibank’s Citi Mobile App provides customers with Touch ID and Face ID authentication, enabling a secure and hassle-free login.

These biometric features decrease the chances of unauthorized access, streamlining customer identification, and adding an extra layer of security.

Big Data and Artificial Intelligence for Personalization

Big Data analytics and Artificial Intelligence (AI) drive data-driven decision-making and personalized experiences in the banking industry.

These technologies empower banks to analyze customer data, offering tailored financial products, targeted marketing campaigns, and actionable insights.

Bank of America's AI-powered virtual assistant, Erica, acts as a financial advisor, offering customers personalized recommendations based on their financial circumstances.

It has significantly improved customer engagement and fostered loyalty.

Instant Lending Through Automation

Digital transformation has streamlined the lending process in banks, leading to prompt, hassle-free approvals.

For example, HDFC Bank in India introduced its 10-second loan approval service, allowing pre-approved customers to avail of personal loans instantly.

This speedy process has been made possible through data analytics, AI, and automation, which are used for efficient underwriting, credit evaluation, and KYC verification.

Predictive Analytics for Risk Assessment

Predictive analytics have redefined risk assessment procedures in banks. Banks use these sophisticated analyses for credit scoring models, fraud detection, anti-money laundering, identifying potential loan defaults, and more.

As an example, the National Australia Bank (NAB) employs predictive analytics to analyze data patterns and detect fraudulent transactions.

It enables the bank to proactively identify risks and prevent potential frauds.

Open Banking and API Integration

Open Banking is another emerging trend in the financial world, enabling banks, fintech companies, and third-party providers to collaborate through APIs.

It gives customers the flexibility to manage various financial services through a single platform.

HSBC, as an example, introduced its Connected Money app, which allows users to view all their financial accounts, including current accounts and credit cards, even from other banks, on a single platform.

Conclusion

Undeniably, the digital revolution has ushered the banking industry into an era of unprecedented change and endless possibilities.

Traditional banking models are evolving at a rapid pace, paving the way towards a customer-centric, efficient, and digitally-enhanced future.

From inventing digital banks and rolling-out mobile apps to harnessing AI and blockchain – the modern banking landscape is indeed a testament to transformative innovation.

However, the key to thriving amidst the seismic shift lies in not only embracing these digital disruptions but also fostering a culture of digital dexterity and lifelong learning.

As the industry treads the path of digitization, it's opening the doors to an efficient, inclusive, and ahead-of-times banking ecosystem.

Embracing this change is no longer an option; it's a strategic imperative for banks worldwide to prosper in these dynamic and digital times.