Table of Contents:

- What Is Robotic Process Automation (RPA)?

- How RPA Streamlines Finance and Accounting Processes

- How RPA Handles Insurance Underwriting and Claims Processes

- Benefits of RPA in Finance and Insurance Industries

- The Future of RPA in Finance and Insurance

Introduction

You know that automation is the future of work, but you might be wondering how exactly it applies to your industry.

If you work in finance or insurance, robotic process automation or RPA is about to become your new best friend.

RPA uses software bots to handle high-volume, repetitive tasks like data entry or invoice processing much more quickly and accurately than humans ever could.

RPA can take over tons of manual work in finance and insurance, freeing up your employees to focus on more strategic, high-value responsibilities.

In this article, we'll explore how RPA is transforming finance and insurance companies.

Stick with us to discover how RPA works, how it benefits the industries, and how you can implement RPA in your own organization.

The future of work is here, and it's time to embrace the bots.

RPA is ready to revolutionize your finance or insurance company.

What Is Robotic Process Automation (RPA)?

So what exactly is robotic process automation or RPA? In simple terms, RPA uses software bots to automate repetitive, rules-based tasks.

These software robots can do things like open applications, enter data, calculate figures, and generate reports. Read this article for further understanding of RPA.

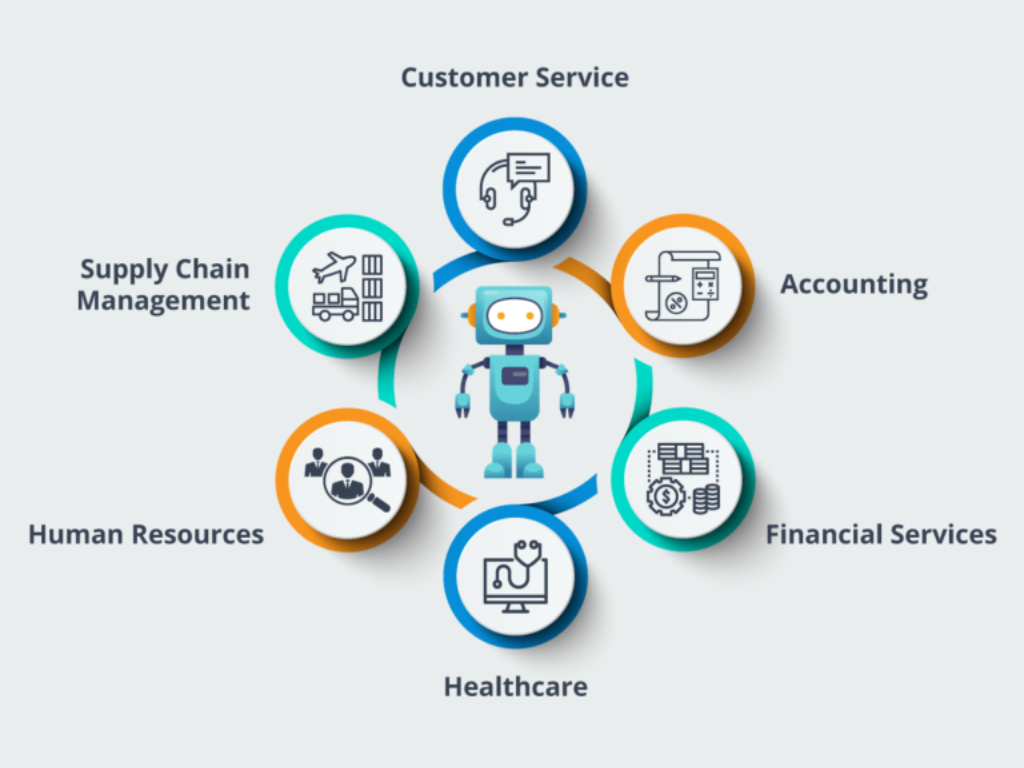

For the finance and insurance industries, RPA has huge potential.

Things like processing insurance claims, underwriting policies, reconciling accounts, and handling customer service inquiries are ideal for RPA.

It is a powerful tool for automating a wide range of tasks and processes, ultimately leading to cost savings, improved efficiency, reduced errors, and enhanced customer service.

RPA may transform finance and insurance, but rest assured - it’s designed to augment human labor, not replace it.

People will still be very much needed, just in new and more interesting roles. The future of work is human and bot, working together.

How RPA Streamlines Finance and Accounting Processes

Automating repetitive, mundane tasks is one of the significant benefits of RPA for finance and insurance companies.

RPA bots can handle many routine processes like data entry, invoice processing, and customer onboarding.

One area RPA excels at is accounts payable. It can log into systems, extract invoice data, match invoices to purchase orders and receipts, calculate discounts, and schedule payments.

This eliminates the manual data entry and validation required for each invoice.

RPA also simplifies account reconciliation. It can log into bank portals, download statements, and reconcile transactions with your accounting records.

Discrepancies get flagged for review. This makes reconciling accounts faster and more accurate.

Reporting is another process RPA improves. It can generate reports on demand by pulling data from various systems.

RPA can schedule reports to run automatically and even distribute them to the right stakeholders.

Real-time reporting gives management insights into key metrics.

By handling routine tasks, RPA frees up staff to focus on high-value work like analysis, optimization, and strategic initiatives.

Together, people and robots are shaping the future of finance and accounting.

How RPA Handles Insurance Underwriting and Claims Processes

RPA is enabling major improvements in insurance underwriting and claims processing.

By automating repetitive, manual tasks, RPA frees up employees to focus on more complex, judgment-based work.

Underwriting

RPA can assist underwriters with many routine tasks like:

- Gathering data from internal and external sources to pre-populate application forms. This reduces the time needed to process applications and decreases errors from manual data entry.

- Calculating risks and premiums based on set rules and algorithms. RPA ensures consistent application of guidelines across all policies.

- Generating correspondence like policy documents, renewal notices, and welcome packets. RPA automatically produces customized documents using templates.

- Monitoring policy compliance by regularly checking that information on file is still correct and up to date. RPA can flag policies that need review so underwriters can follow up.

Claims Processing

In claims, RPA also provides major advantages:

- Registering new claims by extracting data from documents like claim forms, medical reports, and invoices to start the processing workflow. This jumpstarts the claim and reduces manual data entry.

- Validating claims against policy details to ensure the claim is covered before work begins. RPA double checks the claim details match the policy specifications.

- Calculating claim payouts according to the policy conditions and limits. RPA applies the claim calculation rules precisely and objectively.

- Generating standard correspondence for claims like confirmation of claim receipt, requests for additional information, explanation of benefits statements, and settlement communications.

RPA enables claims staff to devote more time to investigating questionable claims, managing complex claims, and providing personalized support to policyholders.

Benefits of RPA in Finance and Insurance Industries

With digital transformation on the rise, the finance and insurance industries are increasingly adopting Robotic Process Automation (RPA) to streamline their operations, enhancing efficiency and customer service.

Here are the benefits of RPA across these sectors with illustrative use cases.

1. Cost-efficiency

Use Case (Finance): Automating Transactions

RPA helps businesses reduce operational costs by automating mundane tasks. In finance, RPA can efficiently handle tasks like updating databases or handling transactions, reducing manual labor costs and freeing up resources for more strategic tasks.

Use Case (Insurance): Automating Data Entry

In the insurance industry, RPA speeds up the monotonous process of data entry, lowering operational costs, reducing human error, and optimizing resources.

2. Enhanced Accuracy

Use Case (Finance): Error-Free Payroll Processing

Financial tasks involving numbers and calculations need precision. By automating payroll processing, RPA helps minimize computation errors, providing accurate and consistent results every time.

Use Case (Insurance): Accurate Claim Processing

RPA, with its faultless execution, can greatly enhance the accuracy of insurance claim processing. Automated checks ensure all claim data is accurate, resulting in faster processing and settlement.

3. Increased Speed

Use Case (Finance): Accelerated Bank Reconciliations

RPA can automate bank reconciliations, matching transactions efficiently, and identifying discrepancies promptly, saving considerable time and effort usually associated with manual processing.

Use Case (Insurance): Efficient Policy Issuance

RPA can accelerate the laborious insurance policy issuance process by verifying customer data, assessing risk, and issuing policies swiftly and accurately.

4. Enhanced Compliance

Use Case (Finance): Maintaining Transaction Records

Finance organizations can leverage RPA to maintain comprehensive transaction records, ensuring compliance with regulatory standards, and making audits straightforward and painless.

Use Case (Insurance): Adherence to Regulations

RPA enables insurance companies to better adhere to ever-changing regulations by maintaining an accurate record of all transactions, facilitating transparency, and auditability.

5. Improved Customer Service

Use Case (Finance): Fast Loan Processing

With RPA, loan processing times can be dramatically reduced as the process of document collection and verification can be automated, resulting in increased efficiencies and improved customer satisfaction.

Use Case (Insurance): Enhanced Customer Onboarding

RPA can streamline the process of onboarding customers in the insurance sector by automating data collection, reducing processing time, and guaranteeing a positive experience for new customers.

6. Scalability

Use Case (Finance): Adapting to Volume Fluctuation

RPA allows financial companies to easily scale their operations to manage peak periods of high transaction volumes, such as during tax season, without disrupting regular operations.

Use Case (Insurance): Scaling Claims Processing

Insurance companies can use RPA bots to manage the increased volume of claims processing during periods of high demand, such as after a natural disaster, without impacting regular operations.

7. Flexibility

Use Case (Finance): Streamlining Legacy Systems

RPA can be integrated with legacy systems to automate operations, offering flexibility and enhancing response time to changes in business or market conditions.

Use Case (Insurance): Integration with CRM systems

Insurance companies can utilize RPA to unify information across various customer contact points, creating a seamless integration between CRM systems and RPA software for improved customer service.

8. Risk Mitigation

Use Case (Finance): Fraud Detection

By automating transaction monitoring and fraud detection, RPA can help mitigate risks in the finance sector, promptly identifying and addressing suspicious activities.

Use Case (Insurance): Risk Assessment

RPA can automate the process of risk assessment in underwriting, making evaluations quicker, more consistent, and free of human error.

9. Resource Allocation

Use Case (Finance): Freeing up Staff for Strategic Tasks

By automating data-intensive tasks such as reporting or reconciliation, RPA enables staff to focus on more strategic, value-adding tasks like financial analysis and decision-making.

Use Case (Insurance): Redirecting Staff towards Customer Engagement

Automating time-consuming tasks such as data entry or claims processing allows insurance staff to spend more time on customer engagement and satisfaction.

10. Digital Transformation

Use Case (Finance): Paperless Approval Process

RPA can help in digital transformation by automating manual paper-based processes. For example, an approval process can be automated using RPA, making it paperless, and speeding up approval times.

Use Case (Insurance): Digitizing Claims Processing

RPA can bring significant advancements in the journey towards digital transformation, for instance, by automating and digitizing the claims processing workflow, thus enhancing efficiency and customer satisfaction.

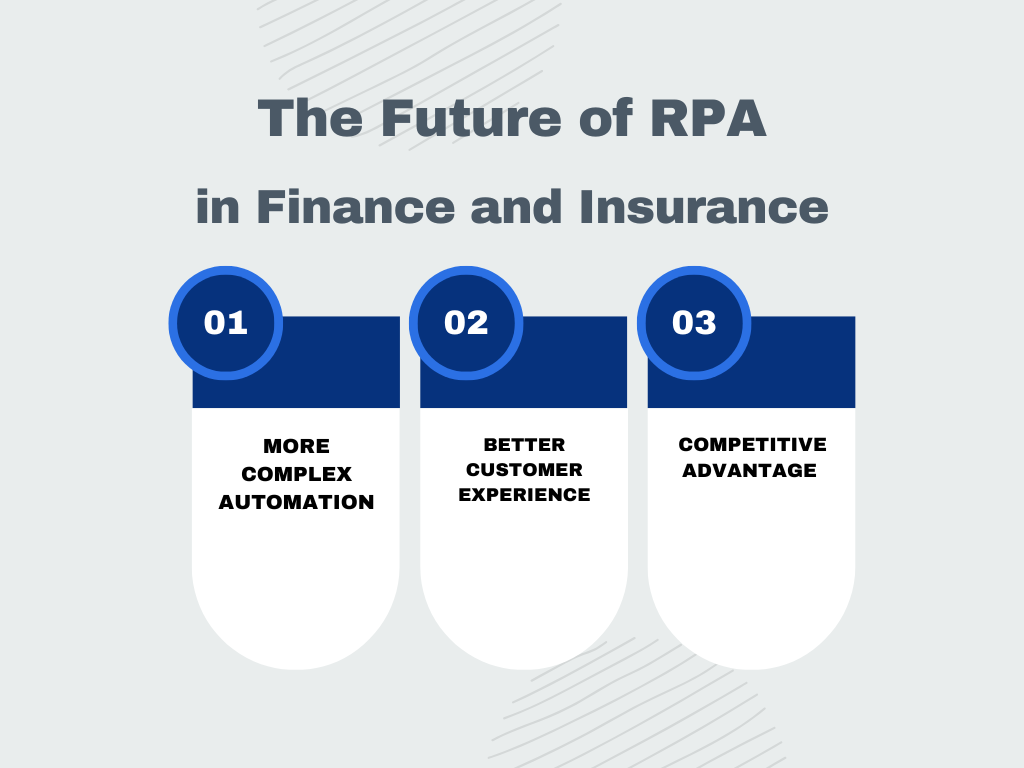

The Future of RPA in Finance and Insurance

The future of RPA in finance and insurance looks very bright. This technology has only begun to scratch the surface of its potential in these industries.

As RPA solutions become more advanced, flexible, and scalable, they will transform finance and insurance in some exciting ways.

Automating More Complex Processes

RPA can currently handle many routine, repetitive tasks like data entry, report generation, and customer service requests.

Going forward, RPA will expand into automating higher-level, more complex processes.

Things like fraud detection, compliance monitoring, claims processing, and underwriting.

RPA bots will use artificial intelligence to analyze huge amounts of data, spot patterns, detect anomalies, calculate risks, and make recommendations to improve these processes.

Providing a Better Customer Experience

RPA will allow finance and insurance companies to deliver faster, more efficient and personalized service to customers.

Chatbots and voice assistants will handle basic questions and requests 24/7.

They'll have access to all customer data and history, so they can resolve issues quickly while providing a seamless experience across channels.

Customer service teams will spend less time handling routine inquiries and more time focused on high-value interactions.

Gaining a Competitive Advantage

The companies that adopt RPA solutions the fastest and most effectively will gain a clear competitive advantage.

They'll save money through increased automation and productivity, and minimize errors and compliance risks.

And also they'll be able to reallocate human employees to more meaningful work.

All of this will allow them to operate more profitably while still enhancing the customer experience.

Conclusion

So if you’re in finance or insurance, don’t get left behind. RPA is the future, and the future is now.

This powerful technology has the potential to overhaul your business processes and transform efficiency, saving you time and money.

The leading companies have already started implementing RPA to gain a competitive advantage.

What are you waiting for? Investing in RPA today represents a strategic move that will pay dividends in enhanced competitiveness, resilience, and customer satisfaction.