Introduction

Efficiency and accuracy in financial processes are crucial for success in any business. One area where businesses can greatly enhance their operations is in the management of invoices.

Manual invoice processing is time-consuming, error-prone, and expensive. However, by automating your invoice processing, you can realize significant benefits that impact your business's efficiency and financial health.

In this blog, we will go through what invoice automation is, its benefits, and how to implement it for your business to help save money, grow, and focus on more critical tasks.

What is Invoice Automation?

Invoice automation is the process of utilizing technology to streamline and automate various stages of invoice processing, from receipt to payment.

This involves the use of software, artificial intelligence, and machine learning to eliminate manual tasks, minimize errors, and expedite the entire invoicing process.

In a conventional invoicing process, employees manually enter data, match invoices with purchase orders, and approve payments.

This can be time-consuming, error-prone, and expensive. Invoice automation replaces these manual tasks with automated workflows, ensuring that invoices are processed accurately and efficiently.

The Benefits of Invoice Automation

Reduce Manual Data Entry and Minimize Errors

Adopting invoice automation software for your business processes has significant benefits. One of the top ways it can improve your business is by reducing manual data entry and minimizing errors.

Currently, 57% of businesses manually enter invoice data into their accounting systems. This tedious task leads to higher costs through wasted time and resources. It also results in frequent data entry mistakes that require correction.

Invoice automation software extracts data from invoices and inputs it directly into your accounting system.

The automated process is more accurate, with an error rate of less than 1% compared to an average of 5-10% for manual entry.

Reducing repetitive manual work and minimizing errors through invoice automation creates a more efficient, productive business environment with lower costs and higher profit margins. This allows you to focus your time and resources on growing your company.

Get Paid Faster With Automated Reminders and Follow-Ups

Invoice automation allows you to send automatic payment reminders to clients with overdue invoices. This helps speed up the accounts receivable process and gets you paid faster.

Automated reminders also save your accounts receivable staff time and effort.

They no longer have to manually review aging reports to see which invoices need reminders and then compose and send individual emails for each one.

By sending timely and consistent reminders, you improve your chances of receiving payment before an invoice becomes seriously past due.

This cash flow boost means greater financial stability and health for your company. Overall, invoice automation is a tool no business should be without.

Free Up Staff to Focus on High-Value Tasks

Manually processing invoices requires employees to spend hours each week printing, sorting, stuffing, sealing, and mailing paper invoices to clients and customers.

Automated electronic invoicing eliminates the need for these tedious tasks, allowing staff to work on responsibilities that boost revenue or improve customer satisfaction.

When staff are freed from repetitive manual work, productivity and morale improve.

Employees tend to feel more motivated and engaged when performing challenging, impactful work.

Their time and talents are better utilized, allowing them to make a bigger contribution to the success of the business.

Improve Visibility Into Cash Flow and Revenue

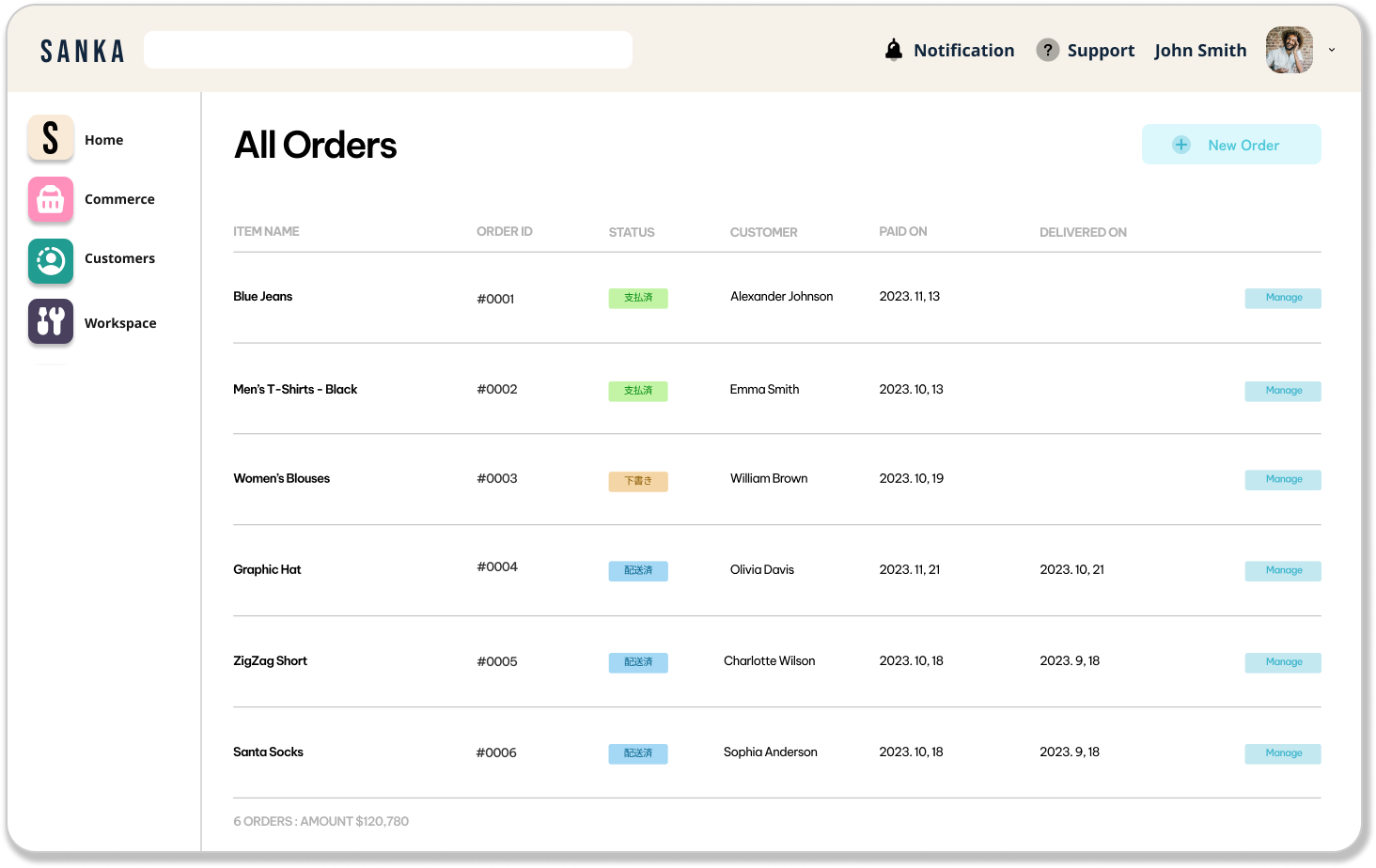

With an automated invoicing system, you can easily view the status of all invoices, payments, and accounts receivable in one place.

Most automated invoicing solutions offer robust reporting features. You can generate on-demand reports for revenue, expenses, accounts receivable aging, and more.

These real-time reports provide an accurate window into your business’s financial position so you can make data-driven decisions at any point in time.

An automated invoicing platform also integrates directly with your accounting software, eliminating manual data entry. Invoices, payments, and other financial data flow seamlessly between systems.

With real-time visibility and streamlined processes, you'll gain control and insight over your business's revenue and cash flow.

Save Time and Money With Streamlined Processes

Automating your invoicing allows you to save time spent on manual data entry and following up on late payments.

Rather than having to enter the same information for each invoice, an automated system can pull details like customer information, items purchased, prices, and more directly from your accounting or ERP software.

Studies show that automated invoice and payment reminders can reduce late payments by up to 50% compared to manual follow-ups.

Some invoice automation platforms offer payment processing services that allow customers to pay right from the invoice.

This one-stop invoicing and payment solution makes it very convenient for customers to pay on time, which can improve cash flow and strengthen customer relationships.

By implementing invoice automation, you can achieve significant time and cost savings, improve cash flow, gain useful business insights, and create a better experience for your customers.

Implementing Invoice Automation for Your Business

Invoice automation is a powerful tool that can transform the way your business handles its invoicing process, saving time, reducing errors, and improving overall efficiency.

If you're ready to implement invoice automation for your business, follow these steps to get started:

- Evaluate Your Current Process: Before implementing invoice automation, it's essential to understand your current invoicing process. Identify any pain points, inefficiencies, or areas where errors are common.

- Choose the Right Solution: There are numerous invoice automation solutions available, so it's crucial to select one that meets your specific needs. Research various invoice automation software solutions, comparing features, pricing, and customer reviews. Look for a solution that aligns with your goals and requirements and fits within your budget.

- Establish Clear Workflows: Define the steps involved in your invoice processing, from receipt to payment, and ensure that your chosen solution can support these workflows.

- Integrate with Existing Systems: Invoice automation should seamlessly integrate with your existing accounting, ERP, or procurement systems to ensure data consistency and accuracy.

- Train Your Staff: Before launching your new invoice automation system, ensure that all employees involved in the invoicing process are adequately trained in using the software. This may include attending webinars, participating in software demonstrations, or completing online training modules.

- Monitor and Optimize: Regularly review the performance of your invoice automation system, using metrics such as time savings, error reduction, and improvements in cash flow. Use this data to make ongoing adjustments and optimizations, ensuring that your business continues to reap the benefits of invoice automation.

Implementing Invoice Automation with Sanka

To get started with invoice automation, consider implementing Sanka, a powerful automation tool designed to execute invoice automation efficiently.

It offers various features and capabilities that can streamline your invoicing process, reducing manual workload, and increasing overall productivity.

Some benefits of using Sanka for invoice automation include:

Easy Integration with Existing Systems

With Sanka, you can easily integrate invoice automation into your existing business processes and systems.

This seamless integration ensures minimal disruption to your daily operations while still taking advantage of the many benefits of automation.

Secure Document Storage

Sanka provides secure document storage, ensuring your sensitive financial data remains protected and accessible only by authorized personnel.

This added security feature can help businesses meet compliance requirements and mitigate potential risks associated with data breaches.

Real-time Data and Analytics

Sanka offers real-time data and analytics, allowing businesses to gain valuable insights into their invoice automation processes.

With this information, you can identify areas for improvement, make data-driven decisions, and better manage your cash flow.

Customer Support and Training

When implementing any new technology, it's essential to have access to support and guidance to help your team get up to speed.

Sanka provides expert customer support and training, ensuring your team feels confident using the tools and maximizing the benefits of invoice automation.

In Conclusion

Invoice automation can revolutionize your business's financial processes, leading to significant time and cost savings, improved accuracy, and better supplier relationships.

Implementing a powerful tool like Sanka can help businesses streamline their invoicing process and better manage their financial operations.

By carefully evaluating your current processes, choosing the right solution, and implementing clear workflows and training, your business can reap the rewards of invoice automation and stay ahead of the competition.